What should I include in the income and expenses sections of a bookkeeping dashboard?

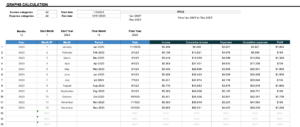

In the income and expenses sections of a bookkeeping dashboard, you should include several key elements to ensure comprehensive tracking. For the income section, include fields for transaction dates, descriptions, income categories, amounts, and any associated taxes. This information helps you categorize and monitor revenue sources accurately. For the expenses section, similar fields are needed, including transaction dates, descriptions, expense categories, amounts, and tax details. Additionally, incorporating dropdown menus for categories and vendors can streamline data entry and improve consistency. By capturing these details, you create a robust record of financial transactions that facilitates accurate reporting and analysis.

Question related to this spreadsheet:

Bookkeeping Dashboard Spreadsheet

The Bookkeeping Dashboard Spreadsheet is a powerful tool designed to enhance your financial management. With its detailed charts and graphs, customizable fields, and intuitive reporting features, this spreadsheet revolutionizes how you track income, manage expenses, and analyze profit trends. Ideal for both small business owners and seasoned accountants, it provides a streamlined solution to take control of your finances confidently. Discover how the Bookkeeping Dashboard can transform your financial management and open new possibilities for success.

Download this spreadsheet:

Download Excel Format

Copy Google Sheet

Spreadsheet Preview

Download Ultimate Charts Spreadsheet:

Download Excel Format

Copy Google Sheet

Related:

Event Planner Spreadsheet

Employee Scheduler Spreadsheet

Project Plan Spreadsheet

Data Visualization Charts