Budget Proposal Presentation | Free Template Download

- Techriv

- February 15, 2024

- Entrepreneurship

- 0 Comments

Introduction

A strategic budget proposal presentation serves as the bedrock of organizational financial planning, providing a roadmap for effective resource management and goal attainment. This meticulously crafted document encapsulates the organization’s vision, priorities, and financial objectives, offering a blueprint for navigating the complexities of today’s business landscape.

Informed by thorough analysis and foresight, a strategic budget proposal presentation empowers decision-makers to allocate resources efficiently, mitigate risks, and seize growth opportunities. Beyond mere numbers, it embodies the organization’s commitment to transparency, accountability, and long-term sustainability, driving success across all facets of operations.

Download this presentation:

Download Powerpoint PPT

Download Apple Keynote

Preview

Download this presentation:

Download Powerpoint PPT

Download Apple Keynote

Budget Variances PPT

Budget variance analysis is a vital practice in financial management, comparing planned budgeted figures with actual results to identify discrepancies. These variances reveal insights into where financial performance deviates from expectations, guiding strategic decision-making to optimize resource allocation and improve overall financial health.

Variances can be positive, indicating areas of outperformance, or negative, signaling potential overspending or inefficiencies. By understanding the root causes of these variances, organizations can implement targeted actions to address issues, streamline processes, and enhance financial performance.

Effective budget variance analysis fosters accountability, transparency, and informed decision-making, enabling organizations to adapt quickly to changing conditions and achieve their financial objectives more efficiently.

Planned vs Actual PPT

This succinct visual encapsulates the comparison between planned and actual financial performance. Through intuitive bar graphs and pie charts, it illustrates expenditure patterns and revenue streams across different categories. By providing a clear depiction of variances between projected and real figures, this summary enables quick identification of areas needing attention. It empowers decision-makers to swiftly address discrepancies, optimize resource allocation, and steer the organization towards its financial objectives.

Download this presentation template:

Download Powerpoint PPT

Download Apple Keynote

Budget Project Management

This image shows the key elements of project budget management, such as Gantt charts, resource allocation, open and pending actions, and budget tracking. Gantt charts help visualize project timelines, tasks, and milestones for better planning and scheduling. Resource allocation ensures the best use of people, materials, and money to meet project goals while controlling costs. Open and pending actions help keep track of ongoing tasks and issues to manage them proactively. Budget tracking allows careful monitoring of expenses to stay within the budget and make informed decisions. Together, these tools help manage projects successfully within budgets and deadlines.

Budget Pacing

Budget pacing involves closely monitoring and managing expenses in line with predetermined budget allocations over a specific timeframe. By tracking actual spending against projected amounts, organizations ensure efficient resource utilization and alignment with strategic goals. This practice enables early identification of deviations, facilitating proactive adjustments to maintain financial stability and optimize resource allocation. Additionally, budget pacing provides valuable insights for forecasting, decision-making, and prioritizing investments, ultimately supporting sustainable growth and financial discipline within the organization.

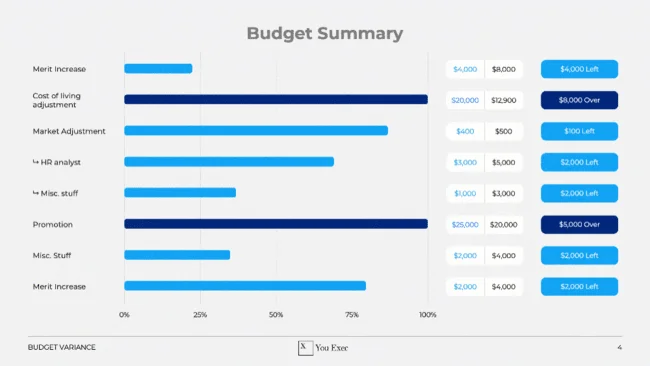

Budget Summery Template

A budget summary provides a concise overview of key financial information contained within a budget. It typically includes essential details such as total income, total expenses, net income or deficit, and any significant variances between planned and actual figures. This summary allows stakeholders to quickly grasp the financial health of an organization or project without delving into detailed budget documents. It serves as a valuable tool for decision-making, enabling stakeholders to identify areas of concern or success and make informed adjustments to financial plans as needed. Overall, a budget summary provides a snapshot of financial performance, aiding in transparency, accountability, and effective resource management.

Understanding Stakeholders

Understanding stakeholders involves identifying all individuals, groups, or entities with an interest in or affected by a project or decision. It requires analyzing their needs, expectations, and concerns to engage them effectively. By building relationships, communicating transparently, and managing their involvement throughout the project, organizations can ensure that stakeholder interests are addressed and that decisions align with broader objectives. Effective stakeholder understanding and management are essential for project success and organizational alignment.

Budget Proposal Template

A budget proposal template is a standardized format designed to streamline the creation of comprehensive budget proposals. Within this template, various sections are dedicated to detailing planned finances, aligning strategic goals with projected revenues and expenses, and ensuring transparent and accountable management. By utilizing a budget proposal presentation template, organizations can effectively communicate their financial plans to stakeholders, ensuring clarity and consistency in conveying crucial information. This structured approach facilitates the presentation of financial data, enabling stakeholders to make informed decisions and optimize resource allocation for sustainable growth and success.

Types of Budgets

Budgets can be classified into various types based on different criteria. Here are some common types of budgets:

-

Functional Budgets: These budgets are based on functions or activities within an organization. Examples include sales budget, production budget, marketing budget, etc.

-

Master Budget: This is an overall budget that comprises all other budgets. It provides an overview of the organization’s financial plans for a specific period, typically one year.

-

Operating Budget: This budget outlines the company’s revenue and expenses from its primary activities, such as sales, production, and day-to-day operations.

-

Capital Budget: This budget focuses on the company’s long-term investments, such as purchasing fixed assets like equipment, machinery, or property.

-

Cash Budget: Cash budget projects the company’s inflows and outflows of cash over a specific period. It helps in ensuring that there’s enough cash available to meet financial obligations.

-

Flexible Budget: A flexible budget adjusts for changes in activity levels. It is useful for businesses with fluctuating levels of production or sales.

-

Static Budget: Unlike a flexible budget, a static budget remains unchanged regardless of changes in activity levels.

-

Zero-Based Budget: In this type of budgeting, all expenses must be justified for each new budget period. It starts from a “zero base,” meaning every expense must be approved rather than basing it on the previous period.

-

Incremental Budget: Incremental budgeting involves making adjustments to the existing budget based on changes in the business environment or other factors. It typically involves increasing or decreasing the budget by a certain percentage.

-

Program Budget: This type of budget allocates resources based on specific programs or projects within an organization.

-

Performance Budget: Performance budgeting links the funding of programs or activities to their performance or outcomes.

-

Expense Budget: This budget focuses solely on an organization’s expenses, outlining how much is allocated to each expense category.

-

Revenue Budget: Conversely, a revenue budget outlines the expected sources and amounts of revenue for a specific period.

Real-Life Examples:

- Company A’s Strategic Budget Proposal: Company A’s budget proposal for the upcoming fiscal year exemplifies meticulous planning and foresight. By incorporating historical data analysis, market trends assessment, and stakeholder input, Company A aligns its budget with organizational priorities while ensuring flexibility to adapt to changing circumstances.

- Nonprofit Organization B’s Impactful Budget Proposal: Nonprofit Organization B’s budget proposal demonstrates a focus on impact and sustainability. With a clear emphasis on programmatic goals and donor stewardship, Organization B effectively communicates its mission-driven budget allocations, fostering trust and engagement among stakeholders.

- Government Agency C’s Transparent Budget Proposal: Government Agency C’s budget proposal emphasizes transparency and accountability. Through detailed breakdowns of expenditures and revenue sources, Agency C provides citizens and policymakers with a comprehensive understanding of public spending priorities and performance metrics.

Download Budget Proposal Presentation:

Download Powerpoint PPT

Download Apple Keynote